Trump’s Tariffs

April 2025 brought some big news for companies exporting to the U.S. With the Trump administration’s latest round of tariffs targeting all goods coming into the country, the cost of importing catamarans into the United States may be higher.

For American buyers, this may mean tough decisions. For international manufacturers, it’s a maze to navigate. These new tariffs will affect the price, your delivery schedule, and your sailing plans.

But there are options — both legal and strategic — for navigating the storm.

The New Global Tariff Map

Here’s how catamaran-producing countries may stack up after the new tariffs. The situation is fluid, with a 90 day pause (minimum tariff of 10% applies).

For a full list of the proposed tariffs by country (sortable), please head to the bottom of this page.

| Country | Proposed Future Tariff Rate |

|---|---|

| E.U. (France, Denmark, Germany, Poland, Finland etc.) | 20% |

| China | 145% |

| Vietnam | 46% |

| Thailand | 37% |

| Indonesia | 32% |

| Argentina | 10% |

| South Africa | 31% |

| UK | 10% |

| Turkey | 10% |

| Australia | 10% |

Major Multihull Manufacturers by Region

European Union (20% Tariff)

- Impact: A 20% bump is painful but possibly manageable for buyers, especially if brands offer partial absorption or U.S. assembly workarounds. Or buyers will flag offshore.

South Africa (31%)

- Impact: South African builders have historically offered great value for quality. The trend will be for buyers to flag offshore. The effect on the charter market in the USVI remains unclear.

Vietnam (46%)

- Impact: Vietnam may be hit the hardest after China. With tariffs at 47%, builders will be watching closely. US buyers will likely flag offshore.

China (34%)

- Impact: Already under trade scrutiny, Chinese brands are hit with a steep hike. It won’t effect buyers with an overseas flag of course.

United Kingdom (10%)

- Impact: The UK is looking at a 10% tariff as a non-EU entity, depending on future trade deals. This could give UK-based brands a relative advantage. However, the industry is small these days. Smaller players like Dazcat could benefit.

What Can U.S. Buyers Do?

1. Take Delivery Abroad

You can take delivery in the British Virgin Islands, Grenada, or Turkey, and keep your boat out of U.S. waters to avoid import duties. Many charter programs support this approach.

2. Buy Used

Used catamarans already in the U.S. won’t be affected by these tariffs. Expect a boom in the used market — and rising prices.

3. Negotiate With the Builder

Some manufacturers may offer to absorb part of the tariff, offer U.S.-based final assembly, or explore alternative delivery methods.

4. Explore Loopholes Carefully

Registering under a foreign flag and cruising internationally is legal but comes with complications around financing, insurance, and U.S. port access.

What Can Manufacturers Do?

Relocate or Diversify Production

- Moving production.

- Others may follow suit, moving to countries with lower duties or even to the U.S. itself — though high labor costs and material tariffs make this tricky.

Offer Knock-Down Kits or Local Assembly

Final assembly in the U.S. might allow for reduced tariffs in some cases. This strategy is complex but could become more common.

Partner With U.S. Dealers

Strong partnerships could help with logistics, financing, and end-user support, creating a smoother buyer experience despite rising costs.

Top 10 Yacht Manufacturing Countries (2025)

1. France – Undisputed #1 for sailing catamarans

Major Brands: Lagoon, Fountaine Pajot, Outremer, Nautitech (via Bavaria), Bali (Catana)

Strength: High-volume production, excellent design pedigree, strong global dealer networks

Exports: Substantial, especially to the U.S., Caribbean, and Europe

2. South Africa – Custom & performance sailing cats

Major Brands: Leopard (Robertson & Caine), Balance Catamarans, Knysna, Kinetic, Maverick

Strengths: Quality craftsmanship, good value, and strong reputation for bluewater performance

Exports: Heavily focused on the U.S. and charter fleets. The blue water cruising boats such as Balance are less likely to be affected as buyers will flag offshore.

3. Vietnam – Rising manufacturing hub

Major Brands: Seawind, Rapido Trimarans, MaxCruise Marine

Strength: Cost-effective, performance-oriented builds, expanding infrastructure

Exports: U.S., Australia, Europe; Seawind is particularly strong in the Pacific market

4. China – Power cats & high-end composites

Major Brands: Aquila, HH Catamarans, Sunreef (select models), McConaghy (multinational)

Strength: Cutting-edge technology, strong in power catamarans, carbon fiber

Exports: U.S., Australia, Europe, Middle East

5. United Kingdom– Low-volume, niche

Major Brands: Dazcat, Broadblue, Archipelago Yachts (Aluminium)

Strength: Local buying appeal, some day-charter and trawler-cat focus

Exports: US, domestic sales

6. Turkey – Emerging base for international brands

Major Players: New Seawind facility, Sirena Marine, boutique builders

Strength: Favourable labor costs, strong in composite builds, growing rapidly

Exports: Europe, U.S., Middle East

7. Poland – Becoming a boatbuilding powerhouse

Major Brands: Sunreef Yachts, Moon Yachts, Viko Yachts (small catamarans), and subcontractors

Strength: Top-tier craftsmanship, growing luxury segment

Exports: Europe, U.S., private owners and luxury market

8. Italy – Stylish and fast-growing niche market

Brands: Silent Yachts (solar-electric cats), C-Catamarans, ITA Catamarans

Strength: Focus on innovation (e.g., solar, hybrid), sleek design ethos

Exports: High-end private market globally

9. Australia – Long history, now mainly design and semi-custom

Major Brands: Older Seawind heritage, Lightwave Yachts, Cure Marine.

Strength: Legacy of robust ocean-going designs

Exports: Regional; many builders moved production offshore (e.g., Vietnam)

10. Argentina – Regional manufacturing and charter support

Brands: Atares

Strength: Regional production, competitive pricing

Exports: US, Latin America and Caribbean

Honorable Mentions:

Portugal – home to Trimarine Composites

Slovenia – Elan and Seascape contribute designs

Germany – Bavaria (owns Nautitech brand)

Philippines – smaller yards, some outsourcing (HH)

Thailand – Custom cats, charter-focused, eg Andaman Yachts.

Summary: Navigating the New Waters

These new tariffs are more than a speed bump — they’re a strategic change in the market. Whether you’re a weekend sailor planning your dream boat or a builder focused on the U.S. market, adaptation will be key.

Buyers will need to think globally, look at the different options available on where to flag their boats, plan smartly, and wait for dust to settle.

Builders will need to innovate — in manufacturing, logistics, and customer support.

In the world of catamarans, boats can sail across borders, but tariffs are bad news, just like in other industries. Ultimately, these new tariffs could be an additional tax on US customers buying boats in their country for those who want to sail in US waters.

It’s easier to navigate this situation in a yacht than a car.

But in any situation such as this, there are opportunities as well as threats.

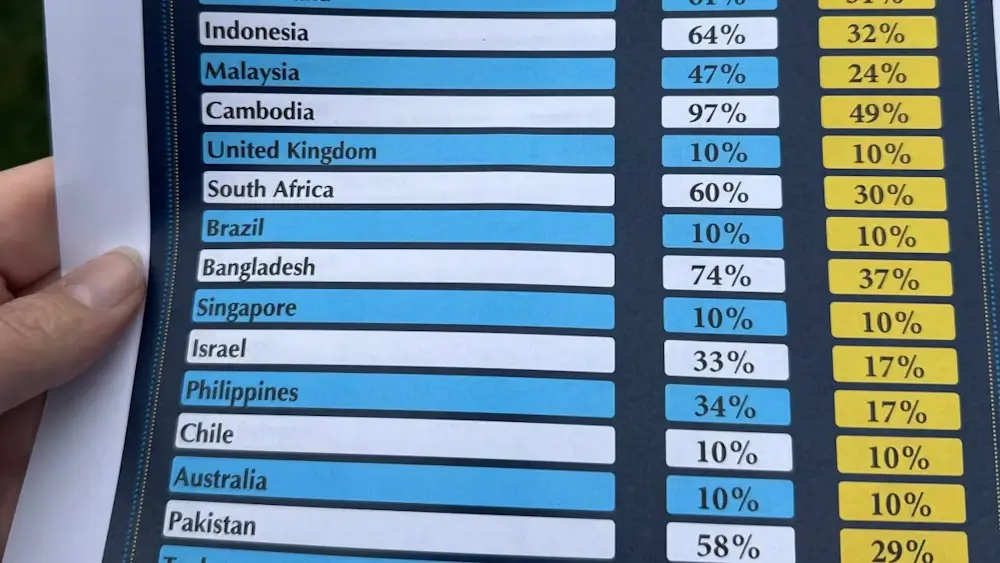

List of all Trump Tariffs by Country

Sortable. Searchable.

| Country | New US Tariffs (%) |

|---|---|

| China | 34 |

| European Union | 20 |

| Vietnam | 46 |

| Taiwan | 32 |

| Japan | 24 |

| India | 26 |

| South Korea | 25 |

| Thailand | 36 |

| Switzerland | 31 |

| Indonesia | 32 |

| Malaysia | 24 |

| Cambodia | 49 |

| United Kingdom | 10 |

| South Africa | 30 |

| Brazil | 10 |

| Bangladesh | 37 |

| Singapore | 10 |

| Israel | 17 |

| Philippines | 17 |

| Chile | 10 |

| Australia | 10 |

| Pakistan | 29 |

| Turkey | 10 |

| Sri Lanka | 44 |

| Colombia | 10 |

| Peru | 10 |

| Nicaragua | 18 |

| Norway | 15 |

| Costa Rica | 10 |

| Jordan | 20 |

| Dominican Republic | 10 |

| United Arab Emirates | 10 |

| New Zealand | 10 |

| Argentina | 10 |

| Ecuador | 10 |

| Guatemala | 10 |

| Honduras | 10 |

| Madagascar | 47 |

| Myanmar | 44 |

| Tunisia | 28 |

| Kazakhstan | 27 |

| Serbia | 37 |

| Egypt | 10 |

| Saudi Arabia | 10 |

| El Salvador | 10 |

| Côte d’Ivoire | 21 |

| Laos | 48 |

| Botswana | 37 |

| Trinidad and Tobago | 10 |

| Morocco | 10 |

| Algeria | 30 |

| Oman | 10 |

| Uruguay | 10 |

| Bahamas | 10 |

| Lesotho | 50 |

| Ukraine | 10 |

| Bahrain | 10 |

| Qatar | 10 |

| Mauritius | 40 |

| Fiji | 32 |

| Iceland | 10 |

| Kenya | 10 |

| Liechtenstein | 37 |

| Guyana | 38 |

| Haiti | 10 |

| Bosnia and Herzegovina | 35 |

| Nigeria | 14 |

| Namibia | 21 |

| Brunei | 24 |

| Bolivia | 10 |

| Panama | 10 |

| Venezuela | 15 |

| North Macedonia | 33 |

| Ethiopia | 10 |

| Ghana | 10 |

| Moldova | 31 |

| Angola | 32 |

| Democratic Republic of the Congo | 11 |

| Jamaica | 10 |

| Mozambique | 16 |

| Paraguay | 10 |

| Zambia | 17 |

| Lebanon | 10 |

| Tanzania | 10 |

| Iraq | 39 |

| Georgia | 10 |

| Senegal | 10 |

| Azerbaijan | 10 |

| Cameroon | 11 |

| Uganda | 10 |

| Albania | 10 |

| Armenia | 10 |

| Nepal | 10 |